QuickBooks accounting software is loaded with features and functionalities; one such feature is to write off bad debts in QuickBooks desktop. This feature is of great assistance in cutting down the confusion and at the same time ensuring accuracy. In case you forget to write off the bad debts, it might end up in miscalculated reports and inaccurate revenue records. Bad debts are basically the unpaid amount by a debtor which cannot be recovered. To maintain a smooth profit and loss record, writing off bad debts is a must in QuickBooks.

The software allows you to perform some basic steps to simply write off the bad debts.

Learn the steps with us in this article and successfully write off bad debts in QuickBooks. However, if you aren’t technically sound and don’t want to perform the steps on your own, then our QuickBooks support team can help you with the process. All you need to do is to give us a call at +1-844-521-0490 and we will provide you with immediate support and assistance.

Read Also: Why QuickBooks error -6123, 0 occurs?

Points to Consider

Before you head to the steps to write off bad debts in QuickBooks, make sure to consider the following pointers:

- It should be noted that you can simply write off bad debts as deductions also.

- After creating the bad debts account, you will be informed about all the different types of bad debts and unpaid invoices.

- You can write off overpayments as well using QuickBooks software.

Why do you need to write off bad debts?

As we mentioned earlier, bad debt is money that can’t be recovered. And writing it off makes it easy to track the profits and the average net turnaround. However, performing the writing-off procedure manually can be a huge task. But QuickBooks makes it easy and possible within a couple of steps.

QuickBooks Desktop software makes writing off bad debts quite easy. It is a dedicated cloud-based accounting software. No need for hiring an Accountant for managing the finances as the QuickBooks software is highly user-friendly.

Read also: What is QuickBooks error code 6147?

Methods to write off bad debts in QuickBooks Desktop

The user can try performing the below methods to write off bad debts successfully in QuickBooks. Let us have a look:

Step 1: Create a Bad Debts Expense Account

- The user needs to first launch the QuickBooks Desktop and head to the settings option.

- Navigate to the list of options, and click on the Charts of Accounts.

- Once done with that create a New Account, by clicking on create

- Hit the Expenses tab from the Account type dropdown.

- In the Detail Type dropdown, click on the Bad Debts option.

- Click on Save and Close tabs and you are ready for the next step

See Also: Fix invalid product & invalid product number error in QuickBooks

Step 2: Close the unpaid invoices

- Initially access the Customers menu and hit on the Receive Payments.

- Enter in the customer’s name in the Received from field.

- Now in the Payment amount space, enter $0.00 and select Discounts and credits.

- In the Amount of Discount field, enter the value that you would like to write off.

- For Discount Account, select the account you added in the previous step

- Now, click on Done.

- Hit Save and Close tabs respectively

Read also: How to Troubleshoot QuickBooks error 12029?

Steps to Write off bad debts in QuickBooks online

The above steps were for QuickBooks desktop, but if you are a QuickBooks online user, then you need to perform the below set of steps to write off bad debts in QuickBooks online:

Step 1: Checkaging accounts receivable

The user can try to perform the below steps to check aging accounts receivable. The steps involved are:

- The user needs to select reports menu.

- Search for and open accounts receivable aging detail report.

- Check which of the outstanding accounts receivable should be written off.

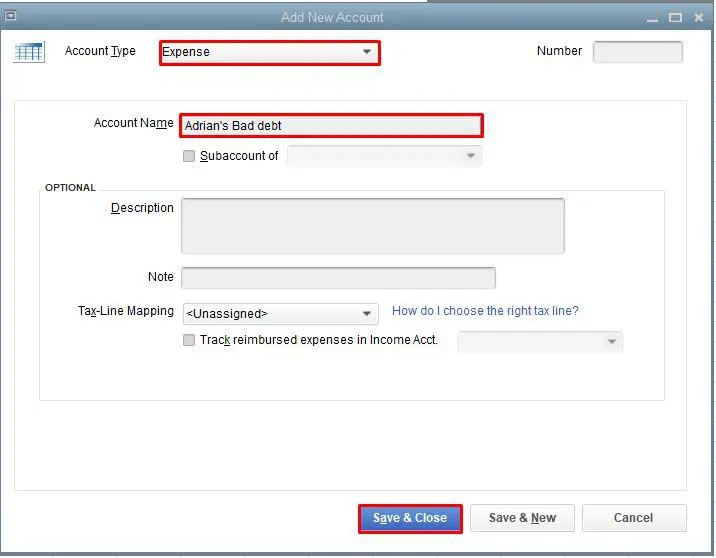

Step 2: Create a bad debt expense account

- The first step is to head to the settings option

- Go for the chart of accounts.

- Opt for new to create a new account.

- From the account type dropdown, select the expenses tab

- From the detail type dropdown, select bad debts.

- Now, go for save and close options, and you are done

You may also like: How to rectify QuickBooks error 3371 status code 11118?

Step 3: Make a bad debt item

- For making a bad debt item, head to the settings tab and then opt for products and services.

- Within products and services, select the new tab and also opt for non-inventory.

- Type bad debts in the name fields.

- Go for bad debts from the income account dropdown.

- Hit save and close tabs respectively.

Step 4: Make a credit note for the bad debt

- To create a credit note pertaining to the bad debt select +New.

- Go for the credit note.

- Select the customer from the customer dropdown.

- In the product/service section, opt for bad debts.

- Enter the amount that you wish to write off in the amount column.

- In the message displayed on the screen, Hit the bad debt tab

- Go for the save button and the close tabs respectively

Step 5: Apply the credit note to the invoice

- At first select + New option

- Under customers, select receive payment

- Select the appropriate customer from the customer dropdown.

- Move to the invoice from the outstanding transactions section.

- From the credits section, go for the credit note.

- Click on save and then hit close.

See Also: How to Fix QuickBooks Error Code 15221?

Step 6: Run a bad debts report

- In order to run a bad debt report, head to the settings option.

- Select the chart of accounts.

- In the action column of the bad debts account, hit the run report option

- Note that you can separate a bad debt entity apart from other customers by adding a note to their name

- Head to the sales menu and also opt for customers.

- Select the customer’s name and also click on edit.

- In the display name field, type in bad debt or No credit after the customer’s name.

- Select the save option and end the process

Read it also: How to Fix the QuickBooks Install Error Code 1601?

To Wrap it up!

We end this post right here, with the hope that the information discussed above might be of some help in writing off bad debts in QuickBooks successfully. However, if there is any query or if the user is stuck at any point in time, then feel free to reach out to our tech support team at +1-844-521-0490 and we will provide you with impeccable support services. We are a team of certified QuickBooks professionals who work round the clock in providing immediate support and assistance.

You may also like:

How to Resolve QuickBooks error code 15107?